When your contractor calls asking for "medium voltage cable," that three-word request conceals a universe of technical specifications, application requirements, and commercial implications. The voltage class alone (5kV, 15kV, 25kV, or 35kV) determines everything from the thickness of the insulation to the types of projects your customer can bid on, and ultimately, which cable sits in your warehouse gathering dust versus flying out the door.

The challenge for electrical distributors is this: manufacturers publish comprehensive voltage charts and NEC tables, but they rarely explain the commercial context that matters to your business. Which voltage classes move fastest? Where do contractors actually encounter specification conflicts? Which cable represents the highest margin opportunity versus the biggest inventory risk?

This guide answers those questions by comparing the four most common medium voltage classes, not just by their electrical characteristics, but by their real-world applications and the strategic stocking decisions they demand from your operation.

Understanding Voltage Classes: More Than Just Numbers

The voltage rating stamped on medium voltage cable represents the maximum phase-to-phase voltage the insulation system can safely handle. But from a distributor's perspective, these voltage classes represent distinct market segments, each with different customer bases, project types, and inventory velocities.

The voltage class determines three critical factors that affect your business. First, it dictates the physical construction of the cable, particularly insulation thickness, which directly impacts weight, diameter, and cost per foot. Second, it defines which applications and industries will specify that cable, essentially segmenting your potential customer base. Third, it influences lead times and manufacturer availability, because not every voltage class receives equal production priority.

Here's what separates each class in terms of both technical requirements and commercial reality:

5kV Cable: This represents the entry point into medium voltage territory, specified primarily for industrial facilities, commercial buildings, and smaller distribution systems. The insulation requirements are modest compared to higher voltage classes, making 5kV the most affordable MV option and the easiest to stock in variety.

15kV Cable: This is the workhorse of commercial and industrial distribution. If your customers regularly bid on projects involving substations, manufacturing plants, or institutional facilities, 15kV cable will be their most frequent medium voltage requirement. The broader insulation creates a noticeably heavier, more expensive cable than 5kV, but the application range makes it essential inventory.

25kV Cable: This voltage class serves utility distribution systems, larger industrial campuses, and increasingly, renewable energy installations. Many distributors overlook 25kV because it sits in an awkward middle ground, but that creates opportunity. Projects specifying 25kV often involve utilities or large commercial developers who value responsiveness and are less price-sensitive than typical commercial contractors.

35kV Cable: This is specialized territory. Hyperscale data centers, utility substations, large solar farms, and wind installations drive demand for 35kV cable. The construction requirements make it the most expensive and physically largest of these four classes, but the project sizes typically justify premium pricing and the customers often need cable immediately.

Technical Specifications: A Side-by-Side Comparison

The table below compares the four voltage classes across the specifications that matter most to your inventory decisions and customer conversations. These represent typical constructions for 133% insulation level, 90°C rated cable with copper tape shielding, which accounts for the majority of commercial applications.

Specification | 5kV | 15kV | 25kV | 35kV |

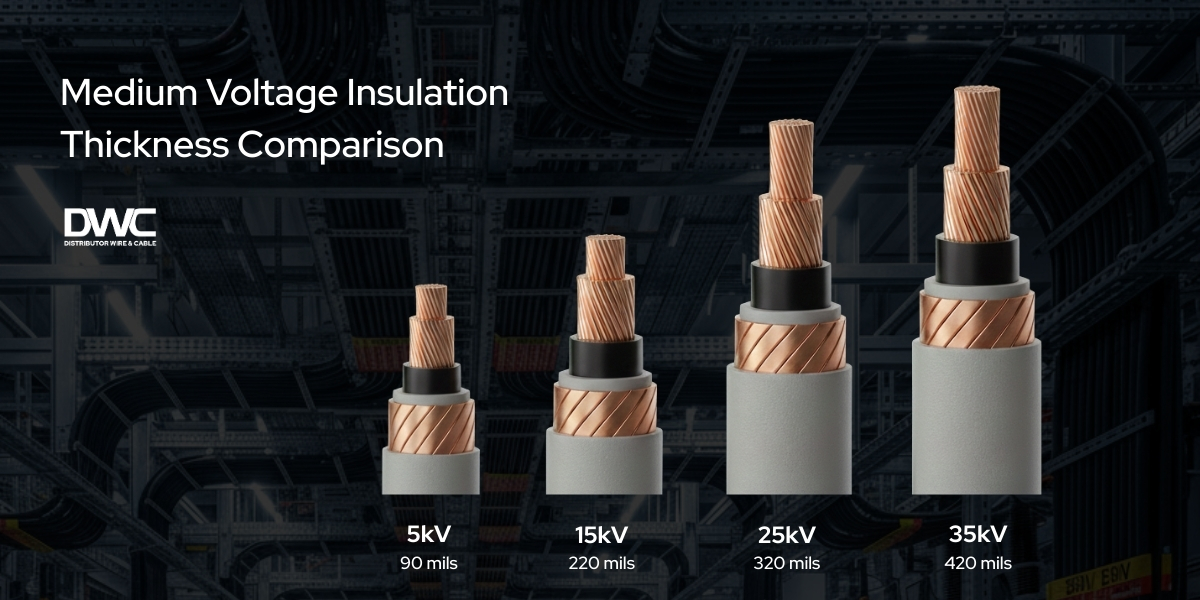

Insulation Thickness (350 kcmil) | 90 mils | 220 mils | 320 mils | 420 mils |

Approximate Cable Diameter (350 kcmil) | 1.14" | 1.42" | 1.70" | 1.98" |

Relative Weight (per 1000') | Baseline | +40% | +75% | +110% |

Typical Price Range (per foot) | $ | $$ | $$$ | $$$$ |

Common Conductor Sizes | 4 AWG - 1000 kcmil | 1/0 AWG - 1500 kcmil | 2 AWG - 2000 kcmil | 1/0 AWG - 2000 kcmil |

Standard Lengths Stocked | 500' - 2500' | 1000' - 5000' | 1000' - 5000' | 2500' - 10000' |

Manufacturer Lead Time (Stock) | 2-4 weeks | 2-4 weeks | 4-8 weeks | 6-12 weeks |

Manufacturer Lead Time (Custom) | 6-8 weeks | 8-12 weeks | 12-16 weeks | 16-20 weeks |

Notice how the insulation thickness nearly doubles with each voltage class jump, and the weight increases follow a similar trajectory. This has immediate implications for freight costs, handling requirements, and the physical space needed in your warehouse. A reel of 35kV cable occupies significantly more floor space and requires heavier lifting equipment than an equivalent length of 5kV.

The lead time differences reveal another critical pattern. Manufacturers prioritize production runs for 15kV because that's where volume demand concentrates. Both 5kV and 25kV often get pushed back in production schedules, while 35kV may require minimum order quantities that make custom runs prohibitively expensive for all but the largest projects.

Application Profiles: Where Each Voltage Class Lives

Understanding where contractors actually encounter each voltage class helps you anticipate demand, position your inventory strategically, and speak credibly when a customer calls with questions. These aren't just theoretical distinctions; they represent the actual project types driving cable purchases.

5kV Cable Applications

The 5kV market centers on commercial and light industrial facilities where distribution voltage doesn't exceed 4,160 volts phase-to-phase. Your customers encounter 5kV specifications most frequently in shopping centers, office buildings, and manufacturing facilities with modest power demands. Many older industrial sites also feature 4,160V distribution systems that were common before 13.8kV became the modern standard.

The contractor advantage with 5kV cable comes down to handling and installation. The smaller diameter and lighter weight translate directly into reduced labor costs for pulling through conduit and terminating connections. For renovation projects in existing buildings where space is constrained, 5kV often represents the only feasible option when upgrading outdated distribution.

From your stocking perspective, 5kV moves fastest in conductor sizes between 4 AWG and 500 kcmil. The emergency replacement market for 5kV deserves attention because many facilities running 4,160V systems are older, meaning cable failures happen more frequently and require immediate response. Having common sizes in stock positions you as the solution when a plant goes down on a Saturday morning.

15kV Cable Applications

This is your bread-and-butter medium voltage inventory. The vast majority of modern commercial and industrial distribution systems operate at 13.8kV or 12.47kV, making 15kV cable the specified choice for everything from hospital substations to university campus distribution to manufacturing facility feeders.

Contractors bidding on institutional projects, shopping mall developments, industrial parks, and multi-building commercial complexes will consistently specify 15kV. The prevalence of this voltage class in modern electrical codes and utility standards means engineers default to 15kV unless specific circumstances demand otherwise. If your customers work with commercial general contractors or serve industrial accounts, 15kV cable will represent their highest-volume MV requirement.

The secondary distribution market also drives steady 15kV demand. Many utilities operate 13.8kV distribution networks, and the cable feeding commercial properties from utility transformers must handle this voltage. This creates parallel demand streams where both the utility contractor and the commercial electrical contractor on the same project may purchase 15kV cable, just in different configurations.

Your stocking strategy for 15kV should emphasize depth over breadth. Concentrate inventory in the conductor sizes between 1/0 AWG and 500 kcmil, which handle 90% of commercial applications. Keep both copper and aluminum options available because contractors make material decisions based on current pricing and pulling requirements, not brand loyalty.

25kV Cable Applications

The 25kV market operates at the intersection of utility distribution and large commercial power systems. This voltage class appears most frequently in utility company specifications for underground residential distribution (URD), rural electric cooperative networks, and primary distribution for large commercial complexes or industrial campuses.

Solar farms represent the fastest-growing application for 25kV cable. As photovoltaic installations scale up to 20 MW and beyond, the collection systems that aggregate power from inverters increasingly operate at 25kV to minimize current and conductor size. Your contractor customers serving the renewable energy market need reliable 25kV sources because these projects operate on aggressive schedules with penalty clauses for delays.

The challenge with 25kV is that demand tends to be project-based rather than continuous. Unlike 15kV where you might ship small quantities weekly for various projects, 25kV typically moves in large orders tied to specific developments. This creates a stocking dilemma where having inventory available creates competitive advantage, but tying up capital in slow-moving cable creates financial risk.

The strategic approach is selective stocking in the most versatile configurations. Single conductor 25kV in 350 kcmil copper with EPR insulation handles the majority of solar and utility applications. Keeping one or two reels of this specification positions you to respond immediately when opportunity surfaces, without creating excessive inventory exposure.

35kV Cable Applications

This is specialized territory with concentrated demand from three primary markets: hyperscale data centers, utility transmission and distribution systems, and large renewable energy installations. The cable itself represents significant investment because the heavy insulation requirements make 35kV the most expensive option per foot across all conductor sizes.

Data center construction drives the most consistent 35kV demand in the commercial market. The massive power requirements of hyperscale facilities, often exceeding 100 MW for a single campus, necessitate primary distribution at 34.5kV to minimize losses and conductor sizes. Technology companies building these facilities operate on fast-track schedules and routinely pay premium pricing for immediate cable availability.

Wind farms and large solar installations increasingly specify 35kV for collector systems, particularly on projects exceeding 50 MW capacity. The utility-scale nature of these developments means contractors need cable in enormous quantities, often 50,000 feet or more for a single project phase. Having established relationships with 35kV suppliers becomes crucial because manufacturers typically require long lead times and substantial minimum orders.

The inventory decision for 35kV differs fundamentally from other voltage classes. Rather than stocking for general availability, the strategic move is positioning yourself as the distributor who can source 35kV quickly and handle the logistics of very large orders. Your value proposition shifts from having cable on the shelf to having the manufacturer relationships and logistics capability to execute major projects.

Stocking Strategy: Matching Inventory to Market Reality

The voltage class comparison reveals a fundamental truth about medium voltage inventory management: you cannot stock everything, and attempting to do so creates financial risk without corresponding opportunity. Your stocking strategy should reflect both the velocity of demand and the availability of supply alternatives.

For 15kV medium voltage cable, depth matters more than breadth. This is your higher-velocity medium voltage inventory where having common conductor sizes immediately available creates competitive advantage. Your customers expect 15kV availability because they encounter it constantly, and losing a sale because you're waiting on a reel represents genuine business risk. That's where DWC comes in. We offer 15kV within a day from all of our 8 cable distribution centers. If you are stocking, focus your capital on 15kV conductor sizes between 1/0 and 500 kcmil in both copper and aluminum, with both EPR and XLPE insulation options.

The 5kV and 25kV medium voltage categories demand a more selective approach. Most ED's don't stock much, if any, of this material. If you do choose to stock, our recommendation is to identify the one or two most versatile specifications and maintain minimal stock positions. Remember, Distributor Wire & Cable has your back when it comes to MV-105. We can get it to you exactly when you and your customers need it. For 5kV, that might mean keeping 350 kcmil copper with EPR insulation. For 25kV, perhaps 4/0 AWG aluminum for URD applications. These represent insurance policies against opportunity rather than volume inventory plays.

With 35kV medium voltage cable, the stocking calculation changes entirely. The slow turnover and high capital requirements make physical inventory impractical for most distributors. Instead, your competitive advantage comes from having established supply relationships that enable fast response when projects surface. This is an where you're almost always going to be partnering with a master distributor like DWC whose reliability and continuity of supply on this mv cable fundamentally changes your risk profile.

The master distributor model transforms how you approach medium voltage inventory across all voltage classes. Rather than tying up hundreds of thousands of dollars in cable that may sit for months, you gain access to depth and breadth of inventory without the carrying costs. When your contractor calls needing 2,500 feet of 25kV cable for a solar project starting Monday, having access to a master distributor's inventory through fastQuote means you win that business despite not physically stocking that specific configuration.

Having the Conversation: Talking Voltage Classes with Contractor Customers

The technical specifications and application profiles matter only if you can translate them into productive conversations with your contractor customers. These conversations typically begin with confusion and end with confidence, assuming you provide guidance rather than simply taking an order.

When a contractor asks about voltage class selection, they're often responding to an engineer's specification without fully understanding why that particular voltage was chosen or whether alternatives exist. Your role is helping them validate the specification against the actual application, which sometimes reveals opportunities to value-engineer the project or avoid costly mistakes.

Start by confirming the actual system voltage rather than accepting the cable voltage class at face value. A contractor saying they need 15kV cable might be working on a 12.47kV distribution system, but they could also be dealing with a 7.2kV system where 15kV represents over-specification. Understanding the actual voltage helps you have informed discussions about whether the specified cable represents the most economical choice or whether alternatives merit consideration.

The insulation level conversation often gets overlooked but creates margin opportunity. The standard 133% insulation level handles the vast majority of applications, but some specifications demand 100% insulation (which requires careful grounding practices) or 173% insulation (which provides additional safety margin). Contractors rarely understand these distinctions, giving you the chance to explain how insulation level affects both pricing and installation requirements.

For applications where voltage class selection isn't rigidly specified, help your customer understand the trade-offs. A 5kV cable costs less per foot than 15kV, but if the actual system voltage approaches 4,160V, the smaller safety margin might create long-term reliability concerns. Conversely, over-specifying voltage class wastes money on unnecessary insulation thickness without improving performance. These conversations build trust by demonstrating you're protecting their interests rather than just processing orders.

The conductor material discussion provides another opportunity to add value. Many specifications list copper without considering aluminum alternatives, but for larger conductor sizes and longer runs, aluminum can reduce total project cost by 30% or more despite larger conductor requirements. Having this conversation early, before the contractor finalizes their bid, positions you as a strategic partner rather than a commodity supplier.

The DWC Advantage: Why Master Distribution Changes the Voltage Class Game

The voltage class comparison exposes a structural challenge for traditional distributor inventory strategies. The enormous variety of specifications across just four voltage classes creates impossible stocking decisions. Do you invest $50,000 in a reel of 25kV cable that might sit for six months? Do you turn away 35kV opportunities because the minimum order quantities exceed what you can reasonably commit?

This is where the master distributor relationship transforms your competitive position. DWC maintains depth of inventory across all voltage classes precisely because we aggregate demand from hundreds of distributors nationwide. The 25kV cable that represents a risky speculation for your single location represents a weekly turn for our network. This inventory aggregation means you gain access to comprehensive voltage class coverage without the capital risk.

The practical impact shows up in three specific ways. First, when your contractor calls with an urgent requirement for an unusual voltage class or conductor size, you can quote and commit immediately through fastQuote rather than spending days sourcing options. Second, you avoid the painful conversation where you tell a valued customer you can't help them because you don't stock their voltage class. Third, you eliminate the financial risk of investing in slow-moving inventory that might become obsolete as project specifications change.

The no-cut-charge policy becomes particularly valuable with higher voltage classes. A reel of 35kV cable might contain 5,000 feet, but your contractor only needs 3,200 feet. With traditional sourcing, either you buy the full reel and eat the excess inventory, or you pay substantial cutting charges that destroy the margin. DWC absorbs both the cutting cost and the reel charges, which often exceed $500 for larger voltage classes. This changes the economics of serving medium voltage projects, particularly for smaller contractors who need shorter lengths.

Emergency availability represents the third dimension of value. When a contractor discovers on Thursday afternoon that their 15kV cable order won't arrive in time for Monday's pour, having access to same-day shipping from DWC's existing inventory prevents costly project delays. This emergency response capability becomes even more critical for higher voltage classes where manufacturer lead times extend to months rather than weeks.

Making Voltage Class Selection Your Competitive Advantage

The four voltage classes covered in this guide represent distinct market segments with different customer bases, application requirements, and inventory dynamics. Understanding these distinctions transforms how you approach medium voltage cable, shifting from reactive order-taking to strategic positioning that creates competitive advantage.

Your contractor customers depend on you to navigate the complexity of voltage class selection because they encounter medium voltage projects infrequently enough that the specifications remain confusing. By mastering the application profiles and trade-offs between 5kV, 15kV, 25kV, and 35kV cable, you become the trusted advisor who prevents costly mistakes and identifies value-engineering opportunities.

The stocking strategy insights reveal that attempting comprehensive inventory coverage across all voltage classes creates financial risk without corresponding reward. Selective depth in high-velocity 15kV, strategic positioning in 5kV and 25kV, and supply relationship emphasis for 35kV creates the optimal balance between availability and capital efficiency.

Partnering with a master distributor like DWC resolves the fundamental tension between inventory breadth and financial prudence. Access to comprehensive voltage class coverage through fastQuote means you can confidently pursue projects across all market segments without betting your capital on slow-moving specialty cable.

The electrical distribution market continues evolving toward higher voltage classes as data center construction accelerates and renewable energy installations scale up. Distributors who understand voltage class distinctions and maintain flexible access to supply across the full range will capture the premium margin opportunities these growing markets represent. Contact your DWC account manager to discuss how our medium voltage inventory can support your growth strategy across all voltage classes.