Walk into any electrical distributor in North America and check their medium voltage inventory. Somewhere between 60 and 70 percent carries a 15kV rating. This isn't random distribution or marketing preference. The dominance of 15kV medium voltage cable reflects a fundamental reality about electrical infrastructure: the two most common utility distribution voltages in North America are 12.47kV and 13.8kV, and 15kV cable with 133% insulation level safely operates on both.

The standardization happened during the 1960s and 70s when utilities were extending service into growing suburbs and building out underground distribution networks. Engineers needed to pick voltage levels that balanced transmission efficiency against equipment costs and safety considerations. Too low, and you couldn't serve loads economically over distance. Too high, and insulation costs, switchgear complexity, and arc flash hazards became impractical for urban distribution. The industry settled on 12.47kV and 13.8kV as the sweet spot for primary distribution from substations to neighborhoods and commercial districts.

Once utilities standardized on those system voltages, cable manufacturers standardized on 15kV as the corresponding cable rating. The 133% insulation level provides necessary safety margin for voltage transients, switching surges, and the reality that electrical systems don't operate at perfect nominal voltage every moment. It's not oversizing; it's proper engineering that accounts for real-world operating conditions. When the entire industry manufactures, stocks, and specifies primarily one voltage rating, costs come down through volume, contractors become familiar with installation requirements, and the positive feedback loop of standardization creates market dominance.

For distributors, this creates a strategic reality: if you're going to stock one medium voltage cable rating, it must be 15kV. Every other voltage has applications, but 15kV is where volume sits. It's also where contractor familiarity lives, and what utilities specify for primary underground distribution. In recent times, data centers have emerged in a big way, and they are building 15kV into their infrastructure plans. Understanding 15kV medium voltage cable means understanding the backbone of electrical distribution in North America and what commercial facilities default to when extending medium voltage distribution systems.

Primary Applications Where 15kV Medium Voltage Cable Dominates

The ubiquity of 15kV cable stems from its presence in virtually every primary distribution scenario. Understanding where your contractor customers specify it helps you identify opportunities and ask the right qualifying questions when projects surface at your counter.

Utility Primary Underground Distribution

Utility primary underground distribution represents the largest single application. When utilities extend service into new developments or underground existing overhead lines, they're installing primary underground cable from substations to padmount transformers throughout neighborhoods. This work almost exclusively uses 15kV cable with concentric neutral construction, which is the shield system that provides both electrical shielding and serves as neutral conductor for grounding.

Utilities require concentric neutral because it creates a complete circuit path for fault currents and allows protective devices to operate properly during ground faults. The concentric neutral wires run helically over the cable insulation shield, typically bare copper or aluminum wires in direct contact with earth when cable is direct buried.

DWC stocks 15kV mv cable with copper tape shield for commercial and industrial applications and ships same day. Concentric neutral construction is available. We also stock 5kV medium voltage, 25kV medium voltage, and 35kV mv cable. When your contractors bring specifications calling for primary underground cable with concentric neutral, that's utility work requiring specialty construction. Request a fastQuote from DWC noting the concentric neutral requirement and any other specification details. We'll source it and provide accurate lead times.

These projects typically involve loop systems or radial systems feeding multiple padmount transformers, with cable runs of several thousand feet from substation to service territory boundaries. Project quantities often run tens of thousands of feet, and margins typically fall in the 12-18% range reflecting special order nature.

Data Centers: The Growth Engine Transforming 15kV MV-105 Distribution

Data centers have emerged as the single largest growth driver in electrical distribution and represent opportunities many distributors are only beginning to understand. The numbers tell a compelling story. From Q1 2024 to Q3 2025, data center investments accounted for over 70% of the increase in private nonresidential construction spending. Since 2019, office construction has declined 19% while data center construction has accelerated over 200%. According to Harvard economist Jason Furman, U.S. GDP growth in the first half of 2025 was almost entirely driven by investment in data centers and related AI technologies.

McKinsey estimates that by 2030, data centers will require $6.7 trillion of investment worldwide. For electrical distributors, this translates to roughly $47 billion in opportunity, with the gray space infrastructure (electrical and HVAC systems) representing 20-30% of total construction value.

Modern data centers standardize on 15kV for primary distribution data center cabling because utility interconnections typically arrive at 12.47kV or 13.8kV, and maintaining that voltage level through the facility simplifies design and reduces transformation losses. These facilities run redundant feeder circuits (A-side and B-side power paths completely separated for reliability) from utility services through the building to unit substations serving server loads.

The hyperscale AI data centers being built by tech giants consume extraordinary amounts of 15kV cable. A single large facility might use a million feet or more of data center cabling during construction, with expansion phases adding hundreds of thousands of feet as capacity grows. Wesco's recent quarterly reports highlighted over a billion dollars in data center generation, demonstrating the scale of these projects.

Data center specifications almost universally call for 15kV EPR or XLPE with tape shield for building distribution, direct burial rated for underground duct banks, and often specify cable tray rating for vertical and horizontal distribution inside buildings. These projects move quickly once engineering is complete, and data center builders work on compressed schedules where delays cost enormous amounts in lost revenue opportunity.

Your competitive advantage when projects like this come up is having a supplier like DWC with stock ready to ship the same day. When your contractors walk in asking about large quantities of 15kV cable with redundant circuit routing requirements, you're hearing an opportunity that justifies immediate attention and competitive pricing to secure the business.

The distinction between gray space and white space matters for understanding where your opportunities sit. Gray space refers to the electrical infrastructure, power distribution, HVAC systems, and backup power (the foundation that makes data centers function). White space refers to the IT equipment areas where servers and networking hardware live. For electrical distributors, the opportunity is overwhelmingly in the gray space infrastructure, and that's where 15kV feeder circuits dominate the cable specification.

These aren't small projects or occasional opportunities. 15kV data center cabling represents sustained, substantial business that creates relationships with contractors specializing in data center construction. There's also the ripple effect from mega data centers built on large tracts in rural areas. These facilities employ thousands during construction and hundreds thereafter for operations, creating economic ecosystems that spawn residential and commercial development around them. Those secondary opportunities (the housing developments for workers, the commercial centers serving new populations) all need electrical infrastructure, and much of that infrastructure runs on 15kV primary distribution feeding the neighborhoods and commercial districts sprouting around data center sites.

When your contractors walk in asking about data center projects, redundant power systems, or A-side/B-side feeder circuits, you're hearing substantial business opportunity. Request a fastQuote from DWC. We have stock and ship same day, giving you the delivery speed that wins these time-sensitive projects.

Commercial, Industrial, and Renewable Energy Applications of 15kV Cable

Commercial and industrial facilities use 15kV medium voltage cable for primary distribution throughout campuses and large buildings. Shopping centers receive utility service at 12.47kV or 13.8kV and distribute through the property to substations serving individual tenant spaces or building sections. Hospitals, universities, and manufacturing facilities run 15kV feeder circuits from main electrical rooms to unit substations distributed throughout buildings or across campuses. These installations typically use 15kV cable in underground duct banks or cable tray systems, with distances measured in hundreds to thousands of feet per circuit.

The distinction between utility projects and commercial/industrial work matters because construction requirements differ. Utilities almost always specify concentric neutral for grounding, while commercial and industrial projects typically use tape shield or wire shield with separate grounding conductors. Utilities have specific specifications that vary by region and often require pre-qualified manufacturers. Commercial and industrial projects follow NEC requirements and engineering specifications that provide more flexibility in product selection. When your contractors ask about primary distribution or feeder circuits for facilities, they're generally not talking about utility work. They need the tape shield or wire shield constructions DWC stocks and ships same day.

Renewable energy installations (solar farms, wind farms, battery storage facilities) represent growing markets for 15kV cable. Solar farms use 15kV to collect power from inverter outputs distributed across the site and route it to collection points for voltage transformation before grid interconnection. Wind farms run 15kV collector systems from individual turbines to central substations. Battery storage facilities use 15kV mv for interconnection circuits. These projects often involve substantial cable quantities. A utility-scale solar farm might need 200,000 to 500,000 feet of 15kV cable for the collection system.

Specifications vary but generally call for direct burial rated cable with tape shield, conductor sizes ranging from 1/0 through 500 MCM depending on inverter outputs and circuit design. When your contractors mention renewable energy projects or ask about solar farm cable, verify whether they're looking at the collection system (15kV) or module-level wiring (600V). The collection system represents the medium voltage opportunity, while module-level wiring is entirely different product category.

Solar contractors doing collection systems need 15kV cable, understand medium voltage requirements, and value distributors who can deliver quickly since these projects work on development timelines with financing deadlines creating schedule pressure. DWC's stock position lets you serve these contractors with same-day shipping.

Understanding 15kV Cable Construction and Specifications

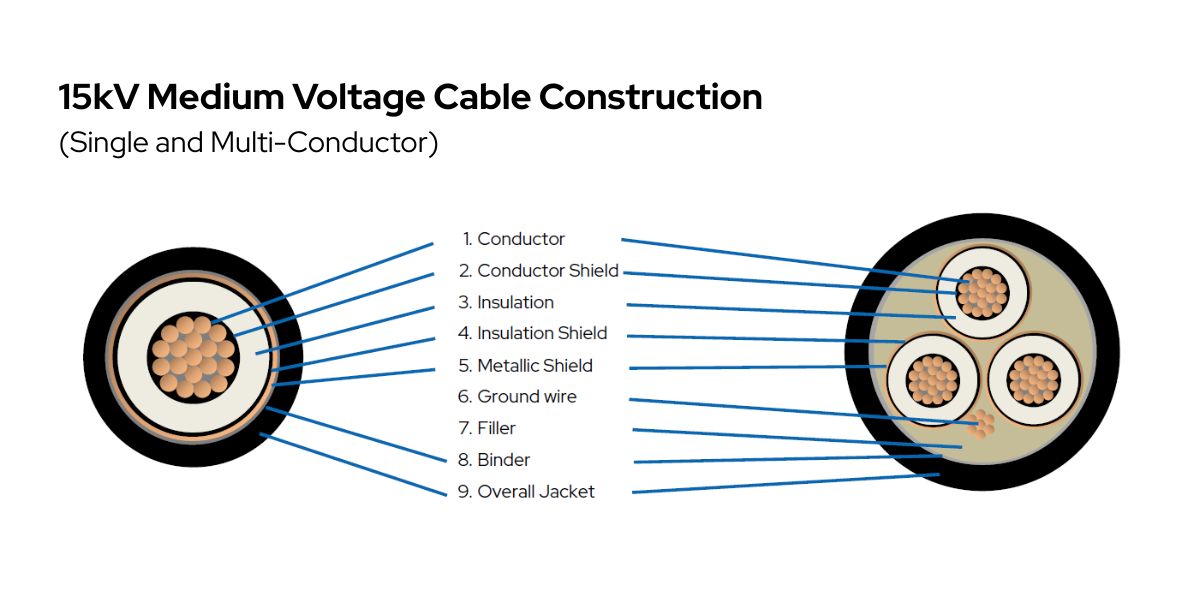

Understanding 15kV cable construction helps you qualify specifications and quote appropriate products to your contractor customers. The cable consists of stranded conductor, insulation system rated for 15,000 volts, insulation shield creating uniform electric field, and outer jacket protecting the cable from physical damage and environmental exposure. All medium voltage cable uses stranded conductors for flexibility. The thick insulation requires this to bend without cracking during installation.

MV Insulation Types: EPR and XLPE

DWC stocks two insulation types, each with distinct characteristics that affect installation and performance.

EPR (ethylene propylene rubber): Carries MV-105 designation indicating 105°C temperature rating. This provides superior flexibility compared to XLPE, handles cold weather installation better, and offers excellent long-term reliability. We stock this with copper tape shield.

XLPE (cross-linked polyethylene): Carries MV-90 designation for 90°C temperature rating, provides excellent electrical properties, and typically costs somewhat less than EPR. We stock this with wire shield.

Both come in 133% insulation level, which means thicker insulation than minimum requirements, providing extended service life and greater safety margin during voltage transients. The table below compares the key differences:

Characteristic | EPR (MV-105) | XLPE (MV-90) |

Temperature Rating | 105°C | 90°C |

Flexibility | Superior (better for tight bends) | More rigid |

Cold Weather Installation | Excellent | Adequate |

Relative Cost | Moderate | Lower |

Shield Type (DWC Stock) | Copper Tape | Wire Shield |

Ampacity Advantage | Higher (due to temperature rating) | Standard |

15kV MV Cable Shield Systems: Tape, Wire, and Concentric Neutral

The shield system serves a critical electrical function. It confines the electric field within the cable insulation and provides ground reference at the cable surface. The three primary shield types serve different purposes and are not interchangeable.

Tape Shield: Uses thin copper or aluminum tape wrapped around the insulation shield, secured with drain wire for termination connections. This construction delivers reliable electrical performance at reasonable cost and represents what DWC stocks for most commercial and industrial applications.

Wire Shield: Uses helically wrapped copper wires around the insulation shield, providing greater mechanical strength than tape shield and meeting specifications requiring wire shield construction, notably FAA requirements and some industrial applications where mechanical durability matters.

Concentric Neutral: Functions differently than tape or wire shields. Where tape and wire shields serve primarily electrical purposes with separate grounding conductors providing circuit neutral and ground functions, concentric neutral shields serve both electrical shielding and neutral conductor roles. The bare copper or aluminum wires wrapped helically around the cable provide a path for unbalanced currents and fault currents, eliminating need for separate neutral conductors and creating complete circuits for utility primary distribution.

Utilities specify concentric neutral because it allows their protective relaying to operate properly during ground faults and provides reliable grounding throughout underground distribution networks. DWC stocks copper tape shield with EPR and wire shields with XLPE for commercial and industrial applications representing the majority of 15kV orders you'll encounter from your contractors. Concentric neutral construction is available when needed for utility projects. When you see specifications calling for concentric neutral, request a fastQuote from DWC noting this requirement and we'll source through manufacturer relationships and provide accurate lead times.

Conductor Options and Temperature Ratings for Medium Voltage

Conductor options matter for qualifying specifications properly. DWC stocks stranded copper conductors in sizes from 1/0 through 750 MCM covering most commercial and industrial applications. Smaller sizes (2 AWG, 1 AWG) and larger sizes (up to 1000 MCM) are available. Aluminum conductors provide cost savings for large conductor sizes and long runs. Some projects specify aluminum for economic reasons, particularly in renewable energy applications where conductor quantities are substantial. Aluminum conductors are available. When specifications call for aluminum, request a fastQuote and we'll provide availability and delivery timeframes.

The temperature rating (105°C for EPR, 90°C for XLPE) affects ampacity, which is the current-carrying capacity determining conductor size selection. Higher temperature rating allows cable to carry more current for given conductor size because insulation withstands higher operating temperature without degradation. Engineers performing circuit design calculations use these ratings to size conductors properly. Your role as distributor isn't performing these calculations (that's engineering work), but understanding that EPR's 105°C rating provides capacity advantage over XLPE's 90°C rating helps you recognize when your contractors might benefit from one insulation type versus the other.

15kV MV-105 NEC Requirements and Installation Standards

NEC treats everything above 600 volts as medium voltage, triggering different installation requirements than low voltage wiring. Article 300.5 requires 24 inches minimum cover for direct burial installations in most circumstances, with deeper requirements (30 inches) under certain conditions including areas subject to vehicle traffic. This is substantially deeper than 600V cable burial requirements, affecting installation labor costs and schedule.

Article 310 provides ampacity tables showing current-carrying capacity for different conductor sizes, insulation types, and installation methods. These tables account for ambient temperature, number of conductors per raceway, and installation configuration. Article 300.50 establishes general requirements for installations operating above 600 volts, including provisions for metallic shields, grounding, and bonding.

When your contractors ask you detailed code questions about installation depth, ampacity calculations, or specific requirement interpretations, your response should be clear and appropriate: "Those engineering and code interpretation questions should be addressed by your electrical engineer or inspector. What I can confirm is that DWC's 15kV cable meets ICEA and UL standards for the constructions we stock."

Installation Methods and Their Requirements

Installation method affects both product selection and installation requirements. Each method carries distinct considerations that influence product specification and contractor approach.

Direct Burial: Places cable directly in earth with specified cover depth, suitable for underground duct banks and most utility primary underground distribution. Cable must be rated for direct burial exposure to moisture.

Duct Installations: Run cable through PVC or HDPE conduits, providing mechanical protection and allowing cable replacement without excavation. This method is common in commercial developments and situations where future modifications are anticipated.

Cable Tray: Supports cable on ladder-type or solid-bottom trays, typically used inside buildings or in situations where cable needs to remain accessible. Cable must be rated for tray use per UL 1277.

Bending radius requirements prevent insulation damage during installation. Medium voltage cable requires larger bending radius than low voltage wire because the thick insulation cracks if bent too sharply. The general rule is 12 times the cable outside diameter for single conductor installations during pulling, with 8 times diameter allowed for permanent installations after cable is pulled. This matters because contractors unfamiliar with medium voltage sometimes damage cable by exceeding bending limits, creating insulation defects that cause failures after energization.

When quoting 15kV cable to your contractors, note on your quote: "Observe manufacturer bending radius requirements during installation." This sets expectations and protects both you and your contractor customers from installation problems.

Standards and Testing Requirements for 15kV Medium Voltage Cable

ICEA standards S-94-649 (EPR) and S-97-682 (XLPE) define construction requirements manufacturers follow. IEEE 48 standards address splice and termination testing procedures. UL 1072 provides safety certification for medium voltage cable. These standards ensure product quality and safety but don't address installation practice or code compliance. Those are separate concerns handled by NEC and local code requirements. Your role is confirming that DWC's cable meets applicable product standards, not interpreting how codes apply to specific installations.

Acceptance testing represents critical requirement many contractors underestimate. Medium voltage installations require testing before energization to verify insulation integrity and confirm proper installation. DC hipot testing applies high DC voltage to cable insulation to detect defects. VLF (very low frequency) testing uses low frequency AC voltage, preferred for aged cable or installations where DC testing might be problematic. After testing, your contractors need certified test reports for electrical inspectors and utility approval.

When quoting 15kV cable to your contractors, add this note: "Medium voltage installations require acceptance testing before energization. Contact us if you need testing service referrals in your area." This sets expectations during the quote phase rather than after installation when your contractors discover inspectors require test reports.

DWC's 15kV Product Portfolio: Stock Availability Drives Competitive Advantage

Understanding what DWC stocks versus sources on request matters because it determines what you can promise your contractor customers for delivery. Stock availability creates your competitive advantage through quick delivery and responsive quotation. Items we source still represent good business but require different qualification, margin expectations, and delivery communication.

What MV Cable Ships Same Day From DWC Stock

The foundation of DWC's 15kV medium voltage offering centers on the configurations that cover the majority of commercial and industrial applications your contractors encounter. We maintain substantial inventory of 15kV EPR with copper tape shield in 133% insulation level, sizes 1/0 through 750 MCM. The EPR insulation provides 105°C temperature rating and superior flexibility for tight bends and cold weather installation. Copper tape shield delivers electrical performance at reasonable cost. Cable is rated for direct burial, duct, and tray installations per UL 1072 and 1277. PVC jacket provides environmental protection for most installation conditions.

Request a fastQuote and we ship same day, giving you dramatic competitive advantage over distributors waiting on manufacturers. We also stock 15kV XLPE with wire shield in 133% insulation level, covering common commercial and industrial applications. The 90°C temperature rating meets most specifications, and wire shield provides mechanical strength for direct burial and duct installations. Stock availability supports quick delivery to your contractors when they need material fast.

Both EPR and XLPE stock positions mean you can respond to most 15kV inquiries with same-day shipping rather than waiting on factory lead times. Temperature ratings affect conductor sizing because engineers calculate ampacity based on insulation temperature capability. Higher temperature rating allows smaller conductor for given current, potentially reducing installation costs.

When your contractors seem uncertain whether EPR or XLPE fits their application better, the simple guidance is this: EPR provides installation advantages through better flexibility and cold weather performance, XLPE typically costs somewhat less. Both meet performance requirements for permanent installations. If their engineer specified particular insulation type, quote what they specified. If specification allows either, quote what DWC has in stock for same-day shipping.

Specialty Constructions Available Through DWC Sourcing

Concentric neutral construction for utility primary underground distribution represents the most common specialty requirement you'll encounter. Utilities require this for grounding and protection coordination, and specifications vary by utility and region. When your contractors bring concentric neutral specifications, request a fastQuote from DWC with complete specification details including conductor size, concentric neutral wire size and quantity, voltage rating, and any utility-specific requirements. We'll source through manufacturer relationships and provide realistic delivery timeframes.

Aluminum conductors offer cost savings for large sizes and long runs, particularly in renewable energy applications where conductor quantities are substantial. Available in most sizes from 1/0 through 1000 MCM. When specifications call for aluminum, verify with your contractor that aluminum is required rather than preferred. Some specifications list aluminum as alternate, allowing copper substitution. If aluminum is required, request a fastQuote noting conductor material and we'll provide availability and lead times.

Armored constructions using aluminum interlocked armor (AIA) or galvanized steel armor provide mechanical protection for installations where physical damage risk justifies additional cost and weight. Industrial facilities sometimes specify armored cable for areas where excavation or equipment movement might damage unarmored cable. Available on request. When your contractors mention armored medium voltage cable, verify whether armor is specification requirement or contractor preference. Armor adds significant cost, and some contractors request it without realizing the price impact.

Special jacket materials including CPE (chlorinated polyethylene) for outdoor exposure and LSZH (low smoke zero halogen) for installations where fire and smoke concerns override cost considerations round out the specialty options. Standard PVC jackets serve most applications, but some specifications require these alternatives. Available through special order with premium pricing reflecting specialty material costs.

Communicating Availability to Your Contractor Customers

The key distinction for your quoting process to contractors is what ships same day versus what requires sourcing. When quoting DWC stock items, state clearly: "This is stock material from DWC. Ships same day after order." When quoting items we need to source, be equally clear: "This construction requires sourcing from manufacturer. Let me get you accurate lead times from DWC."

Your contractors make project commitments based on your delivery promises, so accuracy matters more than optimism. The distinction between immediate availability and sourced products affects their scheduling, their commitments to their customers, and ultimately their satisfaction with you as their supplier. Clear communication about what's stock versus what requires lead time protects relationships and sets realistic expectations that you can consistently meet.

Quoting 15kV Cable to Your Contractor Customers

The quoting process for 15kV cable rewards qualification more than commodity pricing because you're helping your contractors navigate specifications that many don't encounter regularly. Start by establishing application context through simple questions that reveal whether this opportunity fits DWC's stock capabilities and what support your contractor might need beyond material supply.

Understanding Application Context

Application type determines which product construction makes sense and whether specifications might include requirements beyond standard commercial products. Utility primary underground almost certainly involves concentric neutral. Data center work typically specifies redundant circuits with specific diversity routing requirements. Commercial building feeders usually allow tape shield or wire shield with straightforward NEC installation requirements. Industrial applications might involve motor connections, feeder circuits, or plant distribution with varying specification complexity.

A simple question ("What's this cable for?") often reveals whether you're quoting DWC stock for same-day shipping or something we need to source. Installation method affects product selection and sometimes reveals specification questions your contractors haven't considered. Direct burial requires cable rated for soil exposure. Duct installations allow cable without direct burial rating but need to account for pulling tensions and conduit fill. Tray installations require UL 1277 tray rating and involve different support requirements.

When your contractors seem uncertain about installation method, don't make engineering judgments. Suggest they verify with their engineer whether specific rating is required. Your role is recognizing potential specification gaps and suggesting verification, not determining correct application of codes and standards.

Timeline, Quantity, and Margin Strategy

Timeline drives competitive positioning and margin strategy. When your contractors need material quickly for projects already starting or behind schedule, your access to DWC's same-day shipping creates substantial value justifying 20-25% margins. Fast response through fastQuote system (often same-day pricing for stock configurations) converts opportunities where competitors lose to response time delays.

When projects sit in future planning stages with relaxed schedules, your contractors shop more aggressively on price, and your margins might need to come down to 15-18% range to stay competitive. Quantity affects both pricing and delivery logistics. Small quantities (a few hundred feet for a single circuit) typically quote at higher margins (20-25%) because contractors value convenience and quick delivery over aggressive pricing.

Mid-range quantities of several thousand feet represent competitive territory where 18-22% margins balance profitability against market competition. Large projects exceeding 10,000 feet or involving multiple circuits often require more competitive pricing in 15-20% range, but the absolute profit dollars justify lower percentage margins. When quantities reach project scale (data centers, solar farms, large commercial developments), you're competing against other distributors who may have direct relationships with manufacturers, requiring sharp pencils but offering business that materially impacts your year.

Setting Testing Expectations Early

Testing requirements should be addressed in every medium voltage quote to prevent post-installation surprises when your contractors discover electrical inspectors require certified test reports. Add this note to quotes: "Medium voltage installations require acceptance testing before energization. Contact us for testing service referrals if needed." This sets expectations during quotation phase rather than after installation, helps contractors budget properly, and positions you as knowledgeable supplier rather than just material source.

Leveraging fastQuote and Stock Position

The fastQuote system from DWC exists specifically for these opportunities. Quick turnaround on stock configurations beats traditional quotation processes, creating response speed advantage that wins time-sensitive business. Make sure your team knows fastQuote is available for 15kV stock items and understands that fast response for stock material represents competitive advantage worth protecting through consistent use.

When your contractors walk in needing quick pricing, immediately determine whether their specification matches DWC stock items. If yes, submit fastQuote and deliver pricing same day with confidence you can ship same day. If specifications require items we need to source, communicate that clearly. Stock position advantage deserves emphasis in your quotation to contractors.

When quoting DWC stock items, explicitly state: "This is stock material. Ships same day from our supplier. Not factory lead time." Your contractors value this because many of your competitors may be quoting longer lead times. Your access to DWC's stock eliminates delay risk, simplifies contractor procurement, and justifies margins that pure price competitors can't achieve.

For any 15kV project your contractors bring you (whether it's data center feeder circuits, commercial building primary distribution, or renewable energy collection systems), request a fastQuote from DWC. We stock the common configurations and ship same day, giving you the delivery speed that wins projects.

Common Medium Voltage Mistakes That Cost Distributors Business

Understanding where distributors commonly stumble with 15kV cable helps you avoid the problems that damage contractor relationships and lose profitable business. The mistakes typically stem from treating medium voltage as exotic specialty product rather than understanding which configurations are readily available and how to qualify specifications properly.

Treating All 15kV Cable as Identical

The most frequent mistake is assuming all 15kV cable is functionally identical and that product selection is just matching voltage rating. In reality, the distinction between EPR and XLPE insulation types, between tape shield and wire shield and concentric neutral shield, and between standard stock constructions and specialty builds matters enormously for proper specification match and contractor satisfaction. When you treat these distinctions as unimportant details, you quote inappropriate products that either don't meet specifications or cost more than necessary.

EPR versus XLPE matters because temperature ratings affect ampacity calculations and installation characteristics differ. Your contractors asking about 15kV cable might have engineering specifications calling specifically for MV-105 (EPR) or MV-90 (XLPE), and substituting one for the other without verification creates specification compliance issues. The correct approach is asking: "Does your specification call for EPR or XLPE insulation?" If they don't know, suggest they verify with their engineer. If specification allows either, quote what DWC has in stock for same-day shipping and note that alternative insulation type is available if needed.

Shield System Confusion Creates Serious Problems

Shield system confusion creates the most serious misapplication risk. Tape shield, wire shield, and concentric neutral serve different purposes and aren't interchangeable. Utilities require concentric neutral for primary underground distribution because it provides both electrical shielding and neutral conductor function necessary for proper grounding and protection coordination. Commercial and industrial applications typically use tape shield or wire shield with separate grounding conductors.

Quoting tape shield cable for specifications requiring concentric neutral creates serious problems: wrong product for application, safety concerns, specification non-compliance. When you encounter concentric neutral specifications from your contractors, never substitute tape shield to make a stock sale. Request a fastQuote from DWC noting concentric neutral requirement and we'll source proper product. The short-term convenience of forcing a stock sale becomes long-term relationship damage when your contractor installs wrong product and faces rejection from inspectors or utilities.

Missing the Stock Availability Advantage

Not recognizing what DWC actually stocks represents missed opportunity. Some distributors assume all medium voltage requires long lead times because they're unfamiliar with what master distributors actually stock. DWC maintains substantial inventory of 15kV EPR with tape shield and 15kV XLPE with wire shield in common sizes specifically to support same-day shipping.

When your contractors need 15kV cable matching these stock configurations, your response should emphasize that DWC has it in stock and ships same day, not treat it as something that requires weeks of lead time. Failing to communicate this stock position loses business to distributors who understand what's available for immediate delivery. Your competitive advantage exists only if you actually use it by communicating stock availability clearly and submitting fastQuote requests promptly.

Treating Utility Projects Like Commercial Work

Treating utility projects like commercial work creates specification problems because requirements differ fundamentally. Utility primary underground typically requires concentric neutral, follows utility-specific specifications that vary by region, and often requires pre-qualified manufacturers. Commercial and industrial projects follow NEC requirements and engineering specifications with more product flexibility.

When your contractors mention utility work or primary underground distribution for utilities, don't assume DWC's standard commercial stock meets requirements. Ask about concentric neutral requirements, verify whether utility has pre-qualified manufacturer list, and request a fastQuote from DWC with complete specification details for appropriate sourcing. The qualification process takes minutes but prevents quoting wrong products that waste everyone's time.

Failing to Address Testing Requirements

Not discussing testing requirements upfront leads to post-installation problems when your contractors discover electrical inspectors require certified test reports they hadn't budgeted for or scheduled. Medium voltage installations require acceptance testing before energization. This is code requirement, not optional service. Your quotes should include note about testing requirements, and your team should be prepared to provide testing service referrals when contractors ask.

This isn't engineering support you're unqualified to provide. It's basic acknowledgment of code-required services your contractors will need. Setting this expectation during quoting phase rather than after installation protects your contractor relationships and positions you as knowledgeable partner who helps them anticipate project requirements rather than just pushing product.

Missing the Data Center Opportunity

Missing the data center opportunity represents substantial lost business because many distributors don't recognize the scale of 15kV cable consumption these facilities represent or understand that they're accessible markets. The data shows distributors handle 55-60% of data center market revenue (roughly $47 billion in opportunity) with gray space electrical infrastructure representing 20-30% of construction value.

When your contractors walk in asking about data center work, redundant feeder circuits, or A-side/B-side distribution, you're hearing opportunity that might involve hundreds of thousands of feet of cable over time as facilities expand in phases. These projects value quick delivery and competitive pricing. DWC's same-day shipping positions you to compete effectively, but only if your team recognizes data center references as indicators of significant business opportunity worth immediate attention.

Treating data center inquiries like standard commercial building work misses the scale of opportunity these projects represent. Your response to data center mentions should reflect understanding that you're potentially looking at substantial recurring business with contractors who build multiple facilities and expand existing sites over years, not just filling single-project cable needs.

Failing to Qualify Quantity and Delivery Requirements

Another mistake is failing to ask about quantity and delivery logistics upfront. Your contractors asking about 15kV cable might need 500 feet for a single circuit or 50,000 feet for a major project, and your quotation approach should differ dramatically. Small quantities quote at higher margins with emphasis on DWC's same-day shipping. Large quantities require competitive pricing and careful delivery coordination.

Asking about quantity early in the conversation helps you position appropriately and avoid quoting margins that are either too aggressive for small orders or too high for large projects. The question costs nothing but reveals information that fundamentally changes how you approach the opportunity and what margins are realistic for competitive positioning.

Understanding 15kV Cable Creates Market Position

The 15kV market represents the largest single opportunity in medium voltage distribution because it's where utility standardization, commercial and industrial facility requirements, data center infrastructure, and renewable energy projects converge on a single voltage rating. Every distributor competes in this market to some degree, but knowledge creates differentiation that commodity pricing can't overcome.

DWC's stock depth in common 15kV configurations (EPR with tape shield, XLPE with wire shield) means you can deliver quickly to your contractors for the majority of commercial and industrial applications. This stock position creates your competitive advantage against distributors who don't have access to master distributor stock or who treat everything as special order.

When your contractors need 15kV cable for commercial building feeders, industrial facility distribution, data center infrastructure, or renewable energy collection systems, you can respond with confidence that DWC ships same day rather than quoting weeks of lead time. For specialty requirements (concentric neutral for utility projects, aluminum conductors for cost optimization, armored constructions for physical protection), DWC's manufacturer relationships mean we can source what your contractors need even when it's not inventory we maintain.

The response to specialty specifications should always be: "Let me verify availability and lead time with DWC. We can source specialty constructions for your project requirements." Request a fastQuote with specification details, and we'll work through appropriate options and realistic timelines. This maintains relationships with your contractors and captures business rather than turning away customers whose requirements exceed standard stock.

Making fastQuote Your Competitive Weapon

The fastQuote system exists to support competitive response speed for stock items. Quick turnaround on common configurations beats slower quotation processes, winning business where response time matters. Make sure your team understands that fastQuote is available for 15kV stock items and that using it consistently protects competitive advantage DWC's stock position creates.

When your contractors walk in with time-sensitive requirements matching DWC stock configurations, immediate fastQuote submission and same-day pricing response converts opportunities your competitors lose to delay. The system works only if you actually use it, and using it consistently builds habits that capture business when opportunities appear at your counter.

Where Knowledge Creates Profitability

The strategic insight is that 15kV occupies territory where knowledge, stock availability through DWC, and response speed create advantage that pure price competition can't match. Your contractors buying commodity products shop primarily on price because everyone understands the product and availability is universal. Your contractors buying 15kV cable value distributors who understand application requirements, can deliver quickly from stock, quote accurately for specialty constructions, and don't treat medium voltage as exotic territory requiring excessive margins or lengthy delays.

Your next step is straightforward: verify your team knows what DWC stocks in 15kV configurations, understands basic applications where your contractors need these products, and commits to using fastQuote for stock items rather than assuming everything requires long lead times. The data center market alone (with its $47 billion distributor opportunity and sustained growth trajectory) justifies this effort. Add utility primary underground distribution, commercial and industrial feeder circuits, and renewable energy collection systems, and you're looking at recurring business that builds over time and creates relationships with contractors who value suppliers that actually understand what they need.

When your contractors walk in requesting 15kV cable (whether they call it medium voltage, primary underground cable, or feeder circuits), recognize that you're hearing the foundation of medium voltage distribution in North America. Request a fastQuote from DWC for stock configurations, emphasize same-day shipping for competitive advantage, and let us source specialty constructions when specifications require them. That's how you build position in the market where 60-70% of medium voltage cable volume sits, and where understanding creates profitability that commodity pricing strategies can't achieve.