Picture this scenario. A contractor calls asking for 35kV cable for a solar farm interconnection project. Or maybe it's for a hyperscale data center buildout in your territory. Either way, you're facing a decision that's both simple and complicated. Do you stock this specialty voltage rating yourself, or do you partner with someone who already has it on the shelf?

For most electrical distributors, 35kV cable represents the upper boundary of medium voltage distribution. It sits at an interesting intersection right now. On one side, you have explosive market growth. On the other, operational complexity. Understanding when this cable gets specified, why it matters to your customers, and how to serve this market without taking on excessive inventory risk could be one of the most strategic decisions your business makes this decade.

The numbers tell a compelling story. The global medium voltage cable market reached $64.7 billion in 2024 and is projected to grow at a 7.3% compound annual growth rate through 2034, according to Global Market Insights. But here's what matters more for your business. The 16kV to 35kV voltage segment is expanding rapidly due to the shift toward higher efficiency in renewable energy collection systems, where engineers are increasingly specifying 35kV instead of 15kV to reduce transmission line losses.

What does this mean for you? Your contractor customers are beginning to encounter 35kV cable specifications with greater frequency than ever before. Two massive infrastructure waves are driving this change, and they're both happening right now.

Why 35kV Exists: The Engineering Logic Made Simple

Let's start with the basics. Medium voltage cable typically spans from 1kV to 35kV. Think of it in three groups. The 1kV to 15kV range handles most commercial and light industrial applications. Your bread and butter work. The 15kV to 35kV range serves medium to large industrial facilities, utility substations, and increasingly, renewable energy projects. The 35kV to 69kV range handles heavy industrial and large utility transmission, though this upper range ventures beyond what most distributors would classify as core medium voltage business.

Within this framework, 35kV cable occupies a strategic position. The engineering logic is straightforward. Higher voltage allows for lower current at the same power level. Lower current means you can use smaller conductors. Smaller conductors mean lower resistive losses and better efficiency over distance.

For utility-scale renewable energy installations spanning hundreds of acres, or for data centers pulling tens of megawatts from the grid, these efficiency gains compound into substantial operational savings over the project lifetime. That's why the engineers specify 35kV. The incremental cost of the higher-voltage cable gets recovered within a few years through reduced energy losses.

The Two Market Drivers for 35kV You Need to Understand

The surge in 35kV cable specifications stems from two parallel infrastructure buildouts that will define the next decade of electrical distribution.

Data Center Expansion: The Power Density Challenge

Hyperscale data centers are the massive computing facilities that power cloud services, artificial intelligence workloads, and the global internet infrastructure. They represent an unprecedented concentration of electrical load. We're talking about facilities that can demand anywhere from 20 to over 100 megawatts of power.

To put that in perspective, Chindata Group equipped its campus with one 110kV cabin substation and one backup 35kV substation to ensure reliable power distribution for what became Asia's largest single hyperscale data center. The use of 35kV for backup power at this scale shows you how data center operators design redundant systems at high voltage levels to maintain reliability while managing efficiency.

Data centers receive electrical power from the local utility grid in the form of medium voltage, typically in the range of 10kV to 35kV, before stepping it down through transformers for distribution within the facility. This incoming medium voltage feed represents the first critical infrastructure decision in data center design.

Here's where this matters for your business. When your contractor customer is bidding electrical work for a data center expansion, the incoming utility feed at 35kV may represent their first encounter with this voltage class. The specifications will be exacting. The delivery timelines will be compressed. And the expectation for same-day availability will be absolute. Can you meet those expectations?

Renewable Energy Integration: Collection System Economics

The renewable energy story is equally compelling. According to the U.S. Energy Information Administration, United States primary energy production from renewables grew from 7.807 quadrillion BTUs in 2021 to 8.426 quadrillion BTUs in 2023, with solar and wind expansion driving the majority of this growth.

These renewable installations require medium voltage collection systems to gather power from distributed generation sources across large geographic areas and transmit it efficiently to utility interconnection points. Think about a solar farm spanning 2,000 acres generating 100 megawatts or more. How do you collect all that power efficiently?

The engineering logic for specifying 35kV in these applications comes down to efficiency calculations. Collecting power at 15kV would require substantially larger conductors and would incur greater resistive losses than collecting it at 35kV. For the renewable energy developer, the incremental cost of higher-voltage cable and equipment gets offset within a few years by reduced line losses.

For your contractor customer installing this infrastructure, the cable specification is non-negotiable and the delivery window is tight. This is project work with real deadlines and real penalties for delays.

35kV MV-105 Cable Construction: What Makes It Different

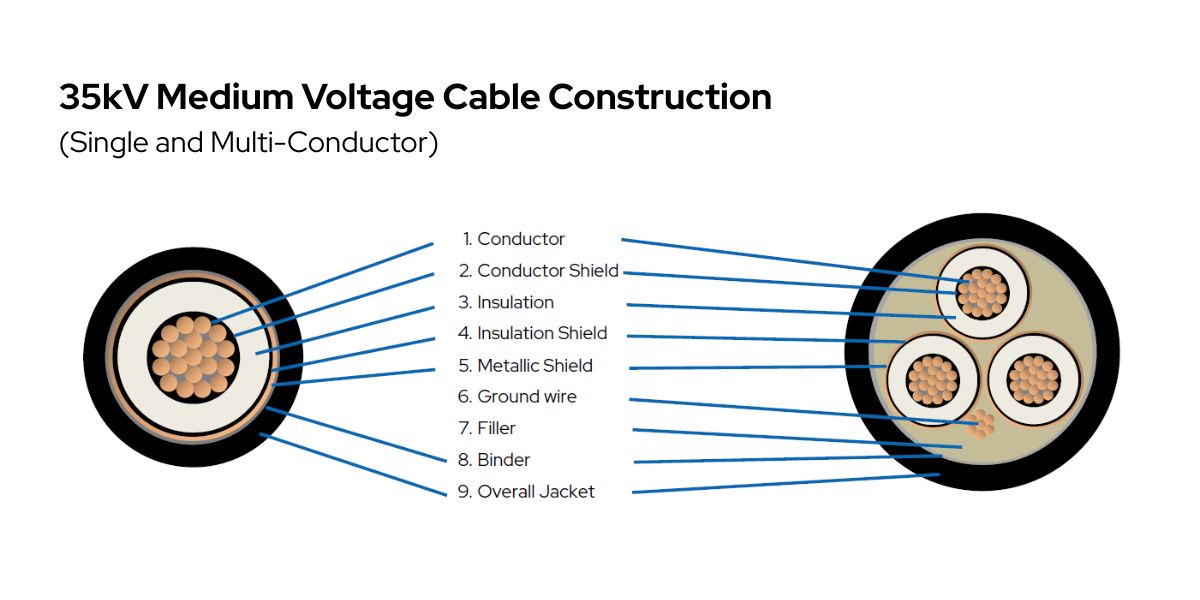

When a 35kV cable specification lands on your desk, understanding what differentiates it from lower voltage ratings helps you guide your customer and protect your margin. The construction follows the same fundamental architecture as other MV cables, but with critical differences in insulation thickness, shielding requirements, and overall design parameters.

Here's the basic structure. You start with a conductor, typically copper or aluminum. Around that, you have the conductor shield, a semiconducting layer that provides a smooth interface between the conductor and the insulation. Then comes the insulation itself, either EPR or XLPE. This insulation must be substantially thicker at 35kV than at lower voltages to withstand the higher dielectric stress.

Next, you have the insulation shield, another semiconducting layer that provides a smooth interface to the metallic shield. The metallic shield, usually copper tape or copper wire, serves multiple functions. It provides a path for fault current. It shields the cable from external electrical interference. It confines the electric field within the cable structure. At 35kV, this shield must be designed to handle higher fault currents than at lower voltages.

Finally, an outer jacket of PVC or PE protects the cable from physical damage, moisture, and environmental exposure.

The Key 35kV Cable Specification Decisions

EPR versus XLPE Insulation: EPR offers superior flexibility, making it easier to install in tight bends or complex routing situations. XLPE costs less and offers excellent dielectric properties but with reduced flexibility. For many 35kV installations in renewable energy and data center applications, XLPE has become the preferred choice due to cost considerations. EPR remains specified when installation conditions demand maximum flexibility.

Copper versus Aluminum Conductors: Copper provides higher conductivity and better mechanical properties but at significantly higher material cost. Aluminum offers substantial cost savings with only modestly reduced conductivity. This makes it increasingly popular for large 35kV installations where the conductor size can be increased slightly to compensate for the lower conductivity without negating the cost advantage.

Specification | 15kV Cable | 25kV Cable | 35kV Cable |

Insulation Thickness (typical) | 175 mils | 220 mils | 260 mils |

Typical Applications | Commercial/Light Industrial | Medium Industrial/Utility | Large Industrial/Data Centers/Renewables |

Cost Premium vs 15kV | Baseline | 15-25% | 30-45% |

Common in Distribution Stock | Yes | Sometimes | Rarely |

The Real Question: Stock 35kV or Source It?

This brings us to the central question facing electrical distributors as 35kV cable demand accelerates. Should you stock it yourself, or should you source it through a partner?

The business case for stocking 35kV medium voltage cable appears compelling on the surface. Your large contractor accounts are increasingly encountering these specifications. The projects are substantial, often representing six or seven-figure cable orders. The margin opportunity exists because many distributors have not yet built 35kV capabilities.

However, the inventory risk is considerable. Let's walk through the math. 35kV cable typically costs 30% to 45% more than equivalent 15kV cable due to the additional insulation, more robust shielding, and tighter manufacturing tolerances. The range of conductor sizes and configurations your customers might specify is broad.

A solar farm might need #2 AWG single conductor for collection circuits. A data center might need 500 kcmil or larger for incoming utility feeds. Stocking even a basic assortment of 35kV cables could tie up hundreds of thousands of dollars in inventory that might sit for months between orders. That's working capital that could be deployed elsewhere in your business.

The alternative approach involves partnering with a master distributor who specializes in medium voltage cable and maintains deep inventory across the full voltage and conductor size range. This model allows you to serve your contractor customers without carrying the inventory risk yourself. When a 35kV specification arrives, you can quote it confidently knowing you have access to stock and can meet delivery timelines.

When Does Direct 35kV Inventory Make Sense?

Consistent Local Demand: If your market includes multiple active data center developments or ongoing renewable energy construction, regular 35kV orders might justify stocking common sizes. You're seeing the specifications come in quarterly or more frequently.

Project Concentration: When you can identify a specific large project requiring multiple deliveries over several months, buying project-specific inventory makes sense. You know the cable will move, and you can negotiate volume pricing with your supplier.

Competitive Advantage: If your competitors lack 35kV capabilities, stocking it positions you as the go-to distributor for high-value MV projects. This can be a real differentiator in your market.

When Does Partnership Make More Sense?

Sporadic Demand: If 35kV orders arrive quarterly or less frequently, the inventory carrying cost exceeds the margin opportunity. You're tying up capital for uncertain returns.

Wide Specification Range: When customers specify different conductor sizes, insulation types, and configurations across different projects, the inventory investment required to cover all possibilities becomes prohibitive. You can't stock everything.

Limited Warehouse Capacity: 35kV cable on large reels requires substantial storage space. If your facility is constrained, that space might be better allocated to faster-turning inventory.

For most electrical distributors operating outside major data center or renewable energy construction markets, the partnership model with a master distributor like DWC offers the optimal balance. You maintain the customer relationship. You quote the project. You earn the margin. But you leverage DWC's inventory depth and MV cable expertise to fulfill the order.

When that emergency call comes in because the contractor miscalculated the required length or because a reel was damaged in transit, DWC's same-day shipping capability becomes your competitive advantage. You solve the problem. You keep the project on schedule. You build customer loyalty that extends far beyond a single cable order.

The Market Growth Story: Why 35kV MV-105 Cable Matters Right Now

The medium voltage cable market is not experiencing linear growth. It's accelerating, driven by infrastructure investments that will compound over the next decade.

Fortune Business Insights projects the global medium voltage cable market will reach $76.31 billion by 2032, growing at a 7.81% CAGR from 2024 through 2032. Within this overall market, the 15kV to 35kV voltage range is seeing increased demand as industries expand and energy distribution networks evolve, with renewable energy sources often operating within this voltage range further contributing to segment growth.

The United States market is particularly robust. Market Research Future reports the U.S. medium voltage cable market is projected to reach $11.15 billion by 2032, driven by aging infrastructure replacement, renewable energy integration, and data center expansion.

For electrical distributors, this growth trajectory means 35kV cable specifications that seem unusual today will become routine within a few years. The question is whether you'll be ready.

The renewable energy buildout represents a multi-decade infrastructure investment. The Inflation Reduction Act and various state renewable portfolio standards are accelerating solar and wind development across the United States. Each utility-scale renewable project requires medium voltage collection systems, often at 35kV, to gather generated power and transmit it to utility interconnection points. As these projects proliferate, the contractors building them will increasingly turn to electrical distributors who can competently quote, source, and deliver 35kV cable on their timelines.

Similarly, data center construction shows no signs of slowing. The explosive growth of artificial intelligence, machine learning, and cloud computing is driving unprecedented data center capacity expansion. Hyperscale facilities are being announced across secondary markets previously not associated with data center construction. Each of these facilities represents a substantial 35kV cable opportunity, from the incoming utility feeds to the internal distribution systems.

What Your Contractor Customers Are Thinking About

When your contractor customer is evaluating a 35kV mv cable specification, several technical considerations will shape their purchasing decision and your role in supporting them. Understanding these concerns positions you as a knowledgeable partner rather than just an order-taker.

Termination Requirements: 35kV cable terminations require specialized techniques and materials beyond what most electricians encounter daily. The high voltage demands careful stress control at the termination point to prevent dielectric breakdown. Your contractor may need guidance on which termination kits to specify and how to source them.

Here's where you can add real value. If you can provide not just the cable but also the complete bill of materials including terminations, splices, and accessories, you become a more valuable partner than a distributor who can only supply the cable itself. You're helping them solve the whole problem, not just part of it.

Testing and Commissioning: 35kV installations typically require high-potential testing before energization to verify insulation integrity. Your contractor should plan for this testing as part of the project schedule. Understanding these requirements and being able to discuss them intelligently builds trust and demonstrates technical competence.

Installation Environment: Whether the cable will be direct buried, installed in conduit, or placed on cable tray affects the specification. Direct burial applications may require additional mechanical protection or armoring. Conduit installations must account for pulling tension limits and the cable's minimum bend radius, which increases with cable size and voltage rating.

Being able to walk through these considerations with your customer demonstrates the kind of technical competence that builds long-term relationships. You're not just selling cable. You're helping them succeed on the project.

Future Capacity Considerations: In many 35kV installations, particularly in data centers and renewable energy facilities, future expansion is anticipated. Your contractor may be installing conduit or duct banks sized for future cable pulls. Understanding these long-term considerations and being able to provide insight into future availability and pricing trends adds value beyond the immediate transaction.

How DWC Solves the 35kV Challenge for Distributors

This is where DWC's master distributor model creates value for electrical distributors navigating the 35kV market. Rather than each distributor independently building 35kV inventory and technical expertise, DWC maintains comprehensive stock across the full range of medium voltage cables including 35kV, in multiple conductor sizes, insulation types, and configurations.

This centralized inventory model means availability when you need it, without the carrying cost burden falling on your balance sheet. But it goes beyond just having stock. Several specific policies make DWC's model particularly valuable for 35kV cable orders.

No Cut Charges: Unlike manufacturers who charge to cut cable from master reels, DWC absorbs these costs. When your contractor needs 2,750 feet of 35kV mv cable but the project specification shows 2,500 feet, you can provide the full length needed without penalizing them for the additional cut charge. This policy protects your margin and strengthens your customer relationship.

No Reel Charges: 35kV cable ships on substantial reels given the cable diameter and weight. DWC's policy of absorbing reel charges eliminates another potential margin erosion point and another negotiation hurdle with your contractor customer. These are real costs that can add up quickly on large orders.

Same-Day Shipping: When a contractor discovers midway through a project that they miscalculated cable requirements or that a reel was damaged in transit, time becomes more valuable than money. DWC's same-day shipping capability means you can solve your customer's emergency and maintain project schedules. This builds loyalty that extends far beyond a single cable order.

fastQuote Portal: The fastQuote system provides instant pricing and availability on medium voltage cable including 35kV across all configurations. When a contractor calls with a 35kV specification, you can provide accurate pricing within minutes rather than days. This improves your close rate and keeps customers from shopping around while they wait for your quote.

Positioning Your Business for the 35kV Opportunity

The acceleration of 35kV medium voltage cable demand represents a strategic inflection point for electrical distributors. The distributors who build 35kV capabilities now, whether through direct inventory or through partnership with a master distributor, will capture the substantial project opportunities emerging across data center construction and renewable energy development.

The distributors who view 35kV as a specialty product outside their core business will cede this high-value market segment to more forward-thinking competitors. That's the reality of where the market is heading.

The choice between stocking 35kV cable directly or partnering with DWC depends on your specific market characteristics, customer base, and operational capabilities. For distributors in markets with consistent 35kV demand driven by ongoing data center or renewable energy construction, building direct inventory capabilities may be justified.

For the majority of electrical distributors, particularly those in secondary markets or with sporadic large project activity, the partnership model offers superior economics and lower risk. You get the capability without the inventory burden. You serve your customers effectively without tying up working capital in slow-moving specialty cable.

What remains non-negotiable is developing the technical competence to discuss 35kV applications intelligently with your contractor customers. Understanding why 35kV is specified, what construction details matter, how it differs from lower voltage cables, and how to source it reliably positions you as a trusted advisor rather than a commodity supplier.

In a market segment growing at 7.3% annually and accelerating, the distributor who can confidently navigate 35kV cable specifications will capture disproportionate value as infrastructure investments compound over the next decade.

The Bottom Line

The global transition to renewable energy and the explosive growth of data center infrastructure are not temporary trends. They represent fundamental shifts in how electrical power is generated, distributed, and consumed. 35kV cable sits at the center of both transformations, making it one of the most strategically important product categories in medium voltage distribution.

The question facing your business is not whether 35kV demand will grow. The market data makes that trajectory clear. The question is whether you will be positioned to capture that growth when your contractor customers increasingly encounter these specifications in their project portfolios.

The answer depends on understanding your market, knowing your customers, and making the strategic decision that aligns with your operational capabilities and growth objectives. Whether that means building direct inventory or partnering with DWC, the key is making the decision now rather than waiting until the opportunity has already shifted to competitors who moved first.

Your contractor customers are already seeing these specifications. The projects are being bid right now. The question is whether they'll call you when they need 35kV cable, or whether they'll call someone else who was ready for this market shift before you were. If you have a data center project hit your desk, remember that DWC is the ideal partner with the widest and deepest inventory in the business for medium voltage. Request a fastQuote today!