The price of copper can make a huge impact on the electrical wholesale industry. Big fluctuations in price play a significant role in the wholesale business landscape. Drastic swings up or down have an effect on every company’s bottom line.

As we stare in the face of a new year, the global economy continues its journey of recovery and transformation. Among the commodities playing a pivotal role in this dynamic landscape is copper, a metal with diverse applications and a history of influencing market trends. Recently, we took time to examine the outlook for copper prices in 2024 and the contextual factors that will shape pricing levels in the new year.

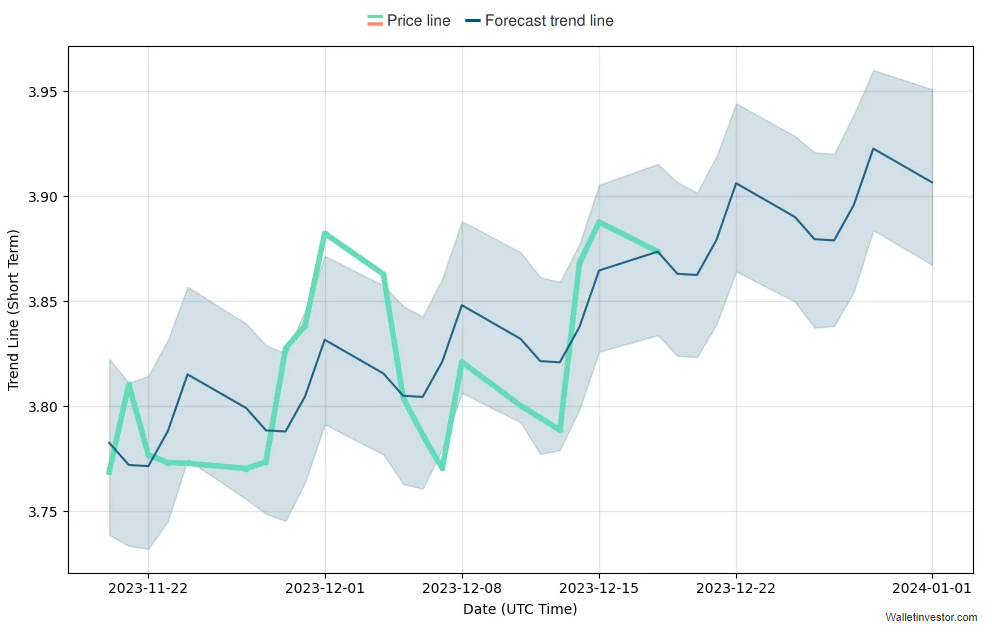

Current State: Here in Q4 2023, copper prices have experienced both volatility and upward momentum. The metal has been trading at elevated levels, driven by a confluence of factors that have reshaped the supply-demand dynamics in the market. Understanding these factors is crucial to trying to predict the future trajectory of copper.

Supply Chain Disruptions: One of the primary drivers of copper prices has been the persistent disruptions in the global supply chain. Various copper-producing regions have faced challenges such as labor strikes, geopolitical tensions, and logistical hurdles, limiting the availability of the red metal. These supply-side constraints have contributed to a tighter market, exerting upward pressure on prices.

Renewable Energy Demand: The global push toward renewable energy sources continues to fuel demand for copper. The metal is an integral component in the construction of solar panels, wind turbines, and electric vehicles. As nations intensify their efforts to combat climate change, the demand for copper in the green energy sector is expected to remain robust, providing sustained support to prices.

Continued Economic Recovery: The broader economic recovery post-pandemic has also played a significant role in influencing copper prices. As industries rebound and construction activities resume, the demand for copper in infrastructure projects and manufacturing has increased. Copper's role as an economic bellwether positions it to benefit from improving economic conditions.

Geopolitical Developments: Geopolitical events can have a profound impact on commodity markets, including copper. Tensions in key copper-producing regions or trade disputes may introduce uncertainties that influence market sentiment and pricing levels. Staying attuned to geopolitical developments will be essential for those closely watching copper prices in 2024.

Outlook for 2024: Looking ahead to 2024, the outlook for copper prices remains contingent on the delicate balance between supply and demand. If disruptions to the global supply chain persist and demand for copper continues to grow, prices may experience sustained strength. However, any resolution to supply chain issues or unexpected shifts in demand patterns could introduce new dynamics to the market.

As we venture into 2024, the copper market stands at a crossroads, shaped by a complex interplay of factors. Supply chain disruptions, renewable energy demand, economic recovery, and geopolitical events will all contribute to the evolving narrative of copper prices. For electrical wholesalers, staying informed and adaptable will be key to navigating the fluctuations and opportunities that the copper market may present in the coming year.

*Disclaimer - The content in this article is for informational purposes only. You should not construe any such information or other material as investment, financial, or other advice. This article represents our own research and we aren't finance professionals. You should consult a financial advisor with specific questions and guidance.